Home loan rates are determined by credit history, loan amount, property type, location, and market conditions. To secure lower rates, maintain excellent credit (above 750), shop around for offers, make substantial down payments (20%+), and negotiate favorable borrower requirements. Lock in rates when market trends suggest increases to protect from future cost rises. Timing is crucial; early locking-in may be expensive, while waiting too long could miss opportunities.

Understanding home loan rates is a cornerstone for any homeowner or aspiring owner, as these rates significantly influence the financial journey ahead. With varying market conditions and lending practices, navigating this landscape can be challenging. This article aims to demystify home loan rates, providing an authoritative guide for homeowners and those seeking to enter the housing market. We will delve into the factors that determine these rates, compare different types of loans, and offer insights on how to secure favorable terms. By the end, readers will possess the knowledge needed to make informed decisions regarding their most significant investment: their home.

Understanding Home Loan Rates: A Comprehensive Overview

Home loan rates are a critical aspect of any borrower’s financial journey, shaping the cost of owning a home. Understanding these rates is paramount for homeowners to make informed decisions and navigate the complex landscape of mortgage financing. This comprehensive overview aims to demystify home loan rates, providing insights into their determination, impact on borrowers, and strategies to optimize borrowing power.

The home loan rate is essentially the interest charged by lenders on a borrowed sum to purchase or refinance a property. It’s not a one-size-fits-all figure but varies based on numerous factors, including credit history, loan amount, property type, location, and market conditions. For instance, fixed-rate mortgages offer consistent monthly payments over a set period, typically 15, 20, or 30 years, while adjustable-rate mortgages (ARMs) have rates that fluctuate according to market indices. Borrowers with excellent credit scores often secure lower rates, reflecting their lower risk profile, whereas those with less-than-perfect credit may face higher rates.

To optimize home loan rates, borrowers should prioritize building or maintaining strong credit scores. This involves timely bill payments, keeping credit card balances low, and avoiding hard inquiries on their credit reports. Additionally, shopping around for lenders and comparing offers can yield significant savings. Lenders compete for business, and this competition translates to better rates for borrowers. It’s also beneficial to consider the loan term—shorter terms generally result in higher monthly payments but lower overall interest paid. Understanding these borrower requirements empowers individuals to make strategic decisions, ensuring they get the best possible deal on their home loan rates.

Factors Influencing Your Mortgage Interest Rate

The home loan rates you receive on a mortgage are influenced by a multitude of factors, each playing a critical role in shaping your borrowing costs. Understanding these elements is crucial for borrowers seeking to secure the best financing options for their new or existing homes. Lenders carefully assess various aspects related to both the borrower and the property to determine the interest rate offered. This comprehensive evaluation ensures that rates are aligned with market conditions and risk profiles, ultimately impacting the long-term financial obligations of homeowners.

Key factors that drive home loan rates include creditworthiness, which lenders gauge through credit scores and historical financial behavior. A strong credit profile with a consistent repayment history often leads to lower interest rates as it signifies lower risk for the lender. Down payment amount is another significant consideration; borrowers making larger down payments may qualify for better rates compared to those putting less equity upfront. Property appraisal and location also factor into the equation. Lenders will evaluate the property’s value, market demand in the area, and any local economic factors that could impact future property values. For instance, homes in desirable neighborhoods or areas with strong economic growth might command higher rates due to perceived increased risk.

In addition to these primary influences, borrower requirements such as loan-to-value ratio (LTV) also play a role. An LTV compares the loan amount to the property’s value, and lenders typically offer lower rates for borrowers with higher down payments that reduce this ratio. Market conditions and prevailing interest rate trends set by central banks are dynamic variables that lenders closely monitor. When interest rates in the broader market fluctuate, so too can home loan rates, affecting both new borrowers and those looking to refinance. Staying informed about these factors and maintaining a strong financial profile can empower borrowers to navigate the mortgage landscape effectively and secure favorable home loan rates.

Strategies to Secure Lower Home Loan Rates

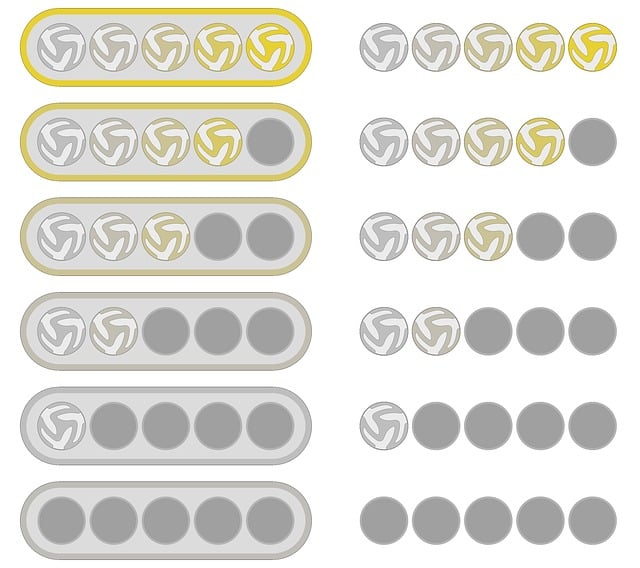

Securing lower home loan rates is a strategic process that requires an understanding of the factors influencing these rates, along with proactive measures on the part of borrowers. One of the primary determinants of home loan rates is the borrower’s credit history and score. A strong credit profile signifies lower risk to lenders, making it easier for borrowers to access competitive rates. For instance, a credit score above 750 often qualifies individuals for better terms compared to those with scores below 650. It’s important to note that maintaining a consistent, positive credit history over time can significantly impact your ability to secure favorable home loan rates.

Another key strategy involves shopping around for multiple offers from different lenders. Comparing home loan rates and associated terms is essential to identify the best options tailored to individual borrower requirements. The range of interest rates offered can vary widely, with differences as high as 0.5% or more between lenders. This variation underscores the importance of taking the time to research and explore various options. Borrowers should not limit themselves to a single lender’s offer without first evaluating market rates and exploring alternatives that align with their financial profiles and borrower requirements.

Down payments also play a significant role in securing lower home loan rates. A higher down payment, typically 20% or more of the property value, can lead to better terms as it reduces the overall risk for lenders. For example, borrowers putting down a larger initial deposit may qualify for a lower interest rate, resulting in substantial savings over the life of the loan. However, it’s crucial to strike a balance between down payment and other financial commitments, ensuring that the home remains affordable beyond the mortgage itself.

Additionally, understanding and negotiating borrower requirements with lenders can further enhance home loan rates. Lenders often consider factors such as stable employment history, lower debt-to-income ratios, and adequate reserves when assessing borrowers. Demonstrating these positive characteristics can strengthen a borrower’s position in negotiations, potentially leading to more favorable terms and lower rates.

Navigating Market Fluctuations: When to Lock in Rates

Navigating market fluctuations is a critical aspect of homeownership, especially when it comes to understanding and managing home loan rates. Home loan rates are subject to change based on various economic factors, making it crucial for borrowers to time their financing decisions wisely. One common question among homeowners is when to lock in rates, ensuring they secure the best possible terms for their mortgage.

The housing market’s ebb and flow can significantly impact home loan rates. Historically low rates have been a boon for buyers, but these favorable conditions don’t last indefinitely. As central banks adjust monetary policies or market uncertainties arise, interest rates tend to rise, reflecting the increased borrowing costs for lenders. For instance, the Federal Reserve’s decisions on federal funds rates often trickle down to mortgage markets, leading to fluctuations in home loan rates. Borrowers should closely monitor these trends and stay informed about economic indicators that influence lending rates.

Locking in a home loan rate is a strategic move, particularly when market conditions suggest an upward trend. Homeowners can protect themselves from potential increases by securing a fixed-rate mortgage before rates rise significantly. This strategy ensures stability and predictability in their monthly payments over the life of the loan. However, timing is critical; locking in rates too early may result in higher costs than necessary if rates drop later. On the other hand, waiting too long could mean missing out on current favorable conditions. Therefore, borrowers should assess their financial situation, compare market rates, and consider their long-term goals when deciding to lock in home loan rates. This proactive approach can save substantial amounts over the lifetime of a mortgage, making it a prudent step for responsible homeowners.